The scrapping of the 'relative poverty' target from the Child Poverty Act 2010, as announced by Duncan Smith today, is the clearest indication yet of the nature of the changes to be announced on 8th July. I stand by my prediction that Osborne will be targeting specifically larger families, rather than making a generalised assault on tax credits - and as well as, of course, new restrictions of Housing Benefit and cuts to disability and incapacity benefits.

Meanwhile, the best commentary and analysis on the child poverty targets - and demolition of Duncan Smith's arguments - comes, as so often, from the churches. Specifically the Joint Public Issues Team of the Methodist, URC, Baptists and Church of Scotland. As they say "The question asked by ...[Duncan Smith's] ... proposed measures is not 'Are you poor?'; it is instead "What personal flaws can your poverty be blamed on?"

Poor Laws

Wednesday, 1 July 2015

Sunday, 14 June 2015

WHAT'S HAPPENING ON JULY 8TH?

In June 2010 the Coalition government announced its intentions for the following five years in their first emergency budget. Against a hastily sketched backdrop featuring the fantasy economics of a 'budget deficit' for an institution that can create its own money, it was the cuts to welfare that, quite deliberately, were given centre stage. Nearly all the £17 billion a year cuts to working age benefits that have been implemented to date were announced in that one budget, or in the spending review a few months later.

This frontal assault on welfare was, it is important to register, an outstanding political success for the Tories. They won the debate. Their principal, if entirely nominal, opponents on the Labour front bench were left making goldfish gawps, then flopping around trying to move in the same direction - as they still are. The irregulars of the (not very) hard left were bemused, since welfare fell outside their stylised and outdated account of what class struggle was supposed to look like. The terms of public debate and understanding - already debased by New Labour - were shifted decisively to the right, to open hatred of the poor. The controlling mind behind the attack - the sadistic thug Osborne not the ineffectual Duncan Smith - learned the value of striking swiftly and early.

Since then the class struggle - which is what we are talking about here - has seen a few victories on our side, like the dispatch of ATOS, but the political impetus has stayed with the Tories. They have cemented their alliance of the relatively affluent - people in stable employment, home owners, many pensioners - in opposition to the threatening hordes of foreigners, disabled people and the dispossessed.

So, on the 8th July, Osborne is going to try the same trick again. His budget will have as its centrepiece the pre-announced but unspecified, additional £12 billion in welfare cuts. The austerity narrative may be falling apart, the figures may be utterly arbitrary, the inevitable effect a further shift of resources to the rich; the key aim however will be to claim more political ground for reaction by creating a new popular consensus. They want not just acquiescence but class hatred and daytime TV shows. They want to be sure of silencing their victims with self loathing.

The main features of Osborne's package of welfare cuts will be determined by these political imperatives. Pensioner benefits will be as far as possible untouched - enough in itself to show that saving money is not the real objective here. Child Benefit is popular and universal so Cameron has reserved that as well. Many of the 2010 cuts did not take effect until 2013; they were still a little nervous of any opposition. This time the entire package has to be effective within two years. The cuts will be relatively larger than before - about one eighth of working age expenditure on my estimate. And they need by their very operation and targeting to establish the worthlessness of their victims

Divination is a hopeless pastime but if we on the left are to meet the renewed political assault on welfare more effectively this time around some haruspicy - inspection of George Osborne's coke spiced entrails - may help us prepare our defensive lines. There are other technical analyses of the problem - I rely mainly on that from the IFS - but the main intention here is to sketch an outline of the political arguments most likely to be used by our enemies in the hope that we will not be completely silenced on July 8th.

So here are some of the horrors we can expect, roughly in descending order of probability:

- Housing Benefit. Big cuts in the £25 billion HB budget are a certainty, all the larger because the pensioner portion will likely be exempted. There are various means they could adopt to do this but the simplest, easiest and most probable - because most politically effective - is to restrict maximum HB to 80 - 90 percent of eligible rent. "Co-payment" is the key phrase - everyone has to pay a portion of their rent, regardless of income. No-one gets a free ride. Claimants have to be incentivised to find cheaper accommodation. Working HB claimants will be hit as much as non-working, private tenants who already pay a shortfall in their rent as much as social sector tenants; but the emphasis will be on putting a stop to 'free' accommodation. This brings rent into line with council tax, in most areas, and lines up with the emphasis on enforcing behavioural change in Universal Credit, the benefit of choice for neo-liberals. The effects will include a huge increase in the number of evictions, the complete conversion of the social housing sector to a neo-liberal enforcement agency, and a further explosion in long term foodbank usage as the available cash income of poor people has to be devoted to rent, fuel, council tax and other state or quasi-state charges. The political response needs to centre on an absolute right to secure, decent housing, regardless of ability to pay.

- taxation of DLA and PIP. But probably not Attendance Allowance (for people aged 65+) and DLA for pensioners. Why should better off disabled people not pay some tax? - except that 'better off' here just means living slightly above subsistence levels. There are very few rich disabled people, for some reason.

- abolition of contributory ESA and JSA. The Tories will take the chance to eliminate the last two remnants of the Beveridge model of welfare, and its contributory principle, at the same time that they are replacing state Retirement Pension with a flat rate version with, effectively, a 35 year residence condition. Contributory JSA is so restricted in scope that it is virtually useless and its abolition will arouse little opposition. Contributory ESA has already been restricted to 12 months payment, except for people in the support group. But there are a lot more people being put into the support group than Duncan Smith expected or intended, because of opposition to ATOS and the work capability assessment, internal and external; and more radical surgery is needed. Plus it simplifies the operation of Universal Credit

- restriction of Child Tax Credit to two children. This, I am predicting, will be the outcome of the debate on cutting back the Tax Credit system - perhaps not the only one because there are a number of other parameters they could adjust, but the biggest. It is a solution that lends itself to reactionary ends. It can be used to promote, and in turn be reinforced by, racist and sexist attitudes towards people with large families. The continued payment of Child Benefit for third and subsequent children can be used to obfuscate the issue, ignoring the difference between £53.31 per week CTC and £13.70 CHB. The alternative is a generalised cut in Tax Credits which is possible but awkward politically - difficult to dress up as anything but an attack on the working poor. Even the Labour Party could manage some degree of opposition to this. But present Labour with this poisonous mix of racism and sexism and they won't know how to react at all. Either way, expect to see a lot more hungry and homeless children, and a lot more fragmented families and children in care. And remember the Tories have long promoted adoption as a solution for the excess poor.

- abolition, complete or effective, of the work related activity component in ESA. To a large extent this is happening anyway. People in the work related activity group, supposedly accepted as having limited capability for work, are increasingly being placed in Work Programme schemes and sanctioned, like regular unemployed folk. Many are struggling to get that far because of delays in assessment and never get out of the "assessment phase". Those who do are all trying to get into the support group which has more money and no WP placements. And again abolition simplifies Universal Credit.

- abolition of Carers Allowance. A possibility if they are desperate enough to reach their £12 billion but I would guess one they would prefer to avoid. It was mentioned February's leaked civil service briefing on possible cuts

- abolition of Industrial Injuries Benefit and transfer to employers. Again a possibility but it would require major legislative surgery and would not be ready in two years. Plus employers would hate it

- restrictions on SSP and SMP. For instance restricting SSP to three months, SMP to six months. A distinct possibility. Employers would like this and it fits well with an increasingly casualised workforce.

- a generalised cut in benefit rates. If they can't get to £12 billion any other way they could always go back to 1931 try a straight cash cut. It split the Labour Party asunder then and guaranteed a National government for a few elections

But that's enough speculation - the inventive fecundity of neo-liberal dungeon masters like Osborne necessarily outruns the imaginative powers of his victims. What matters is that he meets a response in the days and weeks after July 8th and not a stunned silence.

Sunday, 9 November 2014

THE MEANING OF THE COALITION’S WELFARE REFORM PROGRAMME

Silent here for a while; this is because I was writing a big piece on the meaning if welfare reform. This was first published by the International Socialist Network here: http://www.internationalsocialistnetwork.org/index.php/ideas-and-arguments/analysis/506-some-arguments-about-the-uk-government-s-welfare-reform-programme and I,m now working on an edited version for a pamphlet.

Here it is:

Here it is:

THE MEANING OF THE COALITION’S WELFARE REFORM PROGRAMME

- They are not trying (very hard) to reduce welfare expenditure

- They do not want, at all, to reduce benefit dependency

- They are not interested in getting people into work ...

- … because they don’t know what to do with people when they are working

- They are not, exactly, aiming to abolish the welfare state…

- … not least because the present welfare state is their own, neoliberal, creation

- They are converting the DWP into a punitive arm of the state

- They are looking to create a low waged, unskilled, precarious workforce

- They are enforcing a patriarchal discipline on women and families by means testing

- They are winning ...

- ...and Universal Credit will seal their victory for a generation

- They have a problem with pensioners, which they have yet to sort out

- Labour are as deeply committed to these aims as the Tories

- Why it’s ‘Welfare’, not Social Security

- Why it’s back to 1601 not 1834

- No-one asked for welfare

- Against welfare: for class independence

ADDENDUM - on proposals for an unconditional basic income

WHY UNCONDITIONAL BASIC INCOME IS NOT THE SAME AS NEGATIVE INCOME TAX

UNCONDITIONAL BASIC INCOME IS NEITHER A PANACEA NOR A NEOLIBERAL PLOT

GETTING AN UNCONDITIONAL BASIC INCOME IS NOT GOING TO BE EASY

Sources

1. They are not trying (very hard) to reduce welfare expenditure

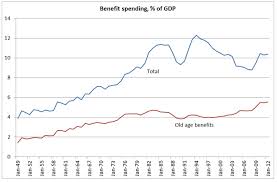

The total welfare spend under the Coalition is still increasing (as critics from the right have noted) instead of flatlining as they originally claimed to plan. Had they been serious about reducing expenditure they could not have largely exempted pensioners, who receive approaching 60% of all welfare payments from the scope of their cuts. Reducing expenditure is not in fact their main aim. Rather they aim to reconfigure both expenditure, and the experience and understanding of welfare, to meet the needs of capital

This does not mean the cuts are not real: they are and they are getting worse but they are concentrated on the working age population. The total planned cuts, not yet fully implemented, amount to about £23 billion a year, or around 25%, compared to what expenditure would have been, for people aged 16-65. The effects are generalised across the working age population, in work and out of work. Disabled people will face the biggest cuts of all proportionately but many of these cuts have yet to be fully implemented. This has been enough to cause widespread hardship but not enough seriously to divert the demographic growth of pensioner welfare and the impact of rising rents and declining real wages. Notably, there has been no attempt at all to reduce the scope of the welfare system, for instance by excluding people in work.

The earliest cuts, from 2010, affected primarily people in work - like the increase (from 16 to 24) in the hours limit above which couples could claim Working Tax Credit; the time limiting of contributory Employment Support Allowance (ESA) - marking the effective end of the contributory system established in 1948 - and restrictions in the rent allowed in private rented accommodation. These amounted to a major attack in themselves but were just a preliminary exercise before the assault which began from April 2013

The biggest reductions in expenditure since 2013 are hidden - they come from below inflation annual uprating (1%; nil from 2015) across most benefits and tax credits combined with a steadily increasing pressure on household incomes. More money is needed for rent because of Housing Benefit reductions; contributions to council tax are now required from all non-pensioner households; working tax credit is reduced, employment support allowance is means tested for people with other resources like a working partner. These cuts are now set to continue indefinitely under the caps on welfare expenditure supported by both Labour and the Tories, creating a background of misery for millions of people at the mercy of the neoliberal state.

More dramatic in effect than these systemic attacks have been cuts which are actually smaller in the savings achieved but deliberately targeted at the points where they produce most pain. The bedroom tax claims to save £500 million and in fact probably saves almost nothing - but people lose their homes through it. The abolition of the Social Fund - emergency cash support from the DWP - saves even less because the help formerly provided was largely in the form of loans and recovered from later benefit payments - but it is the biggest single factor behind the explosion of food bank usage. The abolition of council tax support is producing a cumulative nightmare as one years arrears are added to the next and enforced, increasingly, by bailiff action. The benefit cap affects mainly people with large families or with private rented accommodation in London where it designed to enforce a social cleansing of the most expensive areas. Less than 50,000 households have been affected in total, often not by much and not for long, but the propaganda value has been maximised by publicising a few statistical outliers. (Recent Tory proposals for a reduced benefit cap of £23,000 will have a more widespread effect). Coming in October 2014 is a 7 day waiting period at the start of most benefit claims - again the savings are tiny but the rule is deliberately designed to have maximum impact at the most difficult time. These are cuts for their own sake - official, politically sanctioned sadism with no fiscal or economic rationale at all but intended to normalise and make acceptable new levels of cruelty.

It is the April 2013 cuts that account for the sharp rise in food bank usage since then. They are cumulative, and multiple cuts can affect the same people. It takes time for the full effects of falling incomes and withdrawn services to be felt and sure enough, we are only now beginning to see the first signs of increasingly acute, widespread, distress: homelessness is starting to rise as repossessions increase; household incomes for the poorest families are falling; increasing numbers of children are being taken into care. But it is only eighteen months into this new regime and the worst is yet to come.

Then consider that much of the most acute suffering associated with welfare reform has been caused, not so much by cuts to expenditure as by the associated tightening of claimant discipline through sanctions, and through ATOS medicals. And offset against notional savings to the state through welfare reform should be several billion pounds paid to welfare to work providers like ATOS, G4S and other Work Programme contractors to implement these new punishments - both costly and largely ineffective in their stated aims, these programmes have nonetheless been uncritically adopted by this ‘austerity’ government. These costs are never included if official counts of welfare expenditure. But then reducing overall expenditure on welfare is not really what they are after.

2. They do not want, at all, to reduce benefit dependency

They want to increase benefit dependency (if benefit dependency means being dependent on benefits). They have been doing so systematically, forcing more and more people in work to become claimants, since the Thatcher government introduced rent allowances (a precursor to housing benefit) in 1981 and Family Credit in 1985. Now they are proposing to transfer millions of people from Tax Credits, administered by the HM Revenue and Customs, and housing benefit, administered by local authorities, onto universal credit, a means tested, DWP administered benefit. They are content to leave the forces driving new benefit claims - unemployment, poor health and disability, low paid, insecure work and escalating rents - untouched: indeed they are enforcing substantial rent increases throughout the social housing sector, attacking health and social care provision, cutting jobs and driving down wages wherever they can.They are fully aware that these factors will increase the numbers claiming both in work and out of work support and their actions show that they are fully content to let this happen.

But that is not what they mean when they denounce benefit dependency. They do not actually have a problem with people being dependent on benefits. In fact they like people being dependent on benefits because they are then - precisely - dependent. The last thing our ruling class and its politicians want is an independent, self-reliant working class - they had enough of that in the 1970’s.

Benefit dependency is, first of all, a deliberately created, purely ideological, confection rather than a reflection or real economic and fiscal relationships, which are much more subtle and complicated. Taxation reverses many of the apparent effects of a fortnightly ESA payment while benefits like JSA can, in many cases, can be better considered as deferred wages, an analysis commonly applied to pensions but never to working age benefits. The effective end of most contributory benefits leaves no route open to arguments that your benefit is not a state dole but an entitlement you have paid for. - which is why the Tories have consistently cut contributory benefits, since the 1980’s, and Labour have never restored any of them.

But benefit dependency is also an increasingly brutal fact - a power relation requiring that the claimant subjugates themself to state examination and assessment at regular intervals and accepts that they can have no control over most of the major decisions in their life. This again is a situation neoliberalism is deliberately creating and will make strenuous efforts not to abolish. The usual terms of debate about benefit dependency in fact need to be reversed: it is the left, the working class who should be seeing to abolish dependency on state welfare; it is the ruling class who are determined to maintain it

So what they really mean by benefit dependency is an attitude problem. They mean anyone who thinks that claiming benefit is a right. “On Benefits and Proud”, as the TV programme puts it. They mean anyone who does not cringe and take down their hoodie in their dealings with the state. They mean anyone who does not recognise that their only purpose and the only meaning to themselves and their lives is that they work, or work towards work, or work on the concept of work, even when there is no work. They mean, in long, anyone who does not accept that “the sole duty of man in a commercial society” is “never to leave off conjugating the Imperative Mood, Present Tense, of the verb To keep always at it. Keep thou always at it. Let him keep always at it. Keep we or do we keep always at it. Keep ye or do ye or you keep always at it. Let them keep always at it” as Mr Pancks put it in his great peroration to Bleeding Heart Yard, the Benefits Street of 150 years ago. For unless we are kept always at it we might do something useful, and what would happen then, pray, to the circulation of value?

3. They are not interested in getting people into work ...

They do not give a shit whether people get work or not. Unemployment is a forgotten problem, reclassified as a welfare issue. In the 1980’s, frightened by the 1981 riots, Thatcher’s government introduced genuine job creation schemes like the Community Programme - proper paid jobs, if temporary (I got one). No-one so much as mentions the possibility of job creation schemes now. The Coalition’s flagship scheme for driving people into work, the Work Programme is a proven failure, performing no better than claimants would have done unaided. And for all the efforts of ATOS to drive sick and disabled people off benefit the total numbers of people claiming ESA has hardly reduced - people are cycling on and off ESA and JSA, at reduced levels, rather than getting jobs. The theory underlying these programmes - that unemployment is a ‘supply-side’ problem, caused by over generous benefits - has been comprehensively discredited. (It was only ever a vacuous gesture towards a theory in the first place).

Even when Osborne claims to be targeting ‘full employment’ this is a threat not a concession, given the nature of the employment his policies are producing. Insecure, low paid employment is the very best on offer for most of us. No pay at all is the offer for people on community work placements and is the effective outcome for many notionally self employed people who set up unviable businesses to escape the Jobcentre by claiming tax credits. Add no effective rights at work - because nominal rights have become impossible for most people to enforce since the introduction of fees for Employment Tribunal cases in July 2013 - and the punitive nature of much employment becomes clear.

In fact though,Osborne’s claim is not entirely empty. They do not have any plans for full employment but they do have a scheme to abolish unemployment. Universal Credit, if it is ever fully implemented, will end the separate categorisation of unemployed people claiming Jobseekers Allowance and replace it with a single population of people in low paid or casualised work, unemployed people, people with illnesses and disabilities, single parents, all claiming the same benefit and distinguished only by their ‘conditionality levels’ - the rules they have to satisfy to get benefit. The ‘claimant count’ figure for unemployment will be no more.

None of this is of any concern to the government. The Work Programme works for them because it has opened up more state revenue to the extraction of value by private capital and because it enforces the ideology of ‘work’, rather than increasing the amount of actual work. People may not have been driven off benefit in great number but they have been terrorised, their income cut drastically and their worth - everyone’s worth - redefined as their willingness to be exploited. Which is, more or less, what they wanted.

4. … because they don’t know what to do with people when they are working

And yet the work still isn’t there. Falling unemployment is itself now an artefact of the welfare system as people are driven off benefits into Work Programme schemes or fake self employment; actual employment is barely increasing at all (and in so far as it has increased the increase is driven by more people staying on in employment than by people starting work). There is a slightly frantic quality to the constant invocation of work as the sole fitting aim to life, to the endlessly repeated story of the “hard working family” whose only function is to be the vehicle of a manufactured outrage against the supposedly idle. Our ruling class, and much of the left, appear to believe in a myth of meritorious, productive work, probably in a factory making useful widgets, established by an entrepreneur who works all hours to maintain his business and his loyal workforce. The actual experience of most work - even of inherently valuable work - is by contrast of layer upon layer of bureaucracy, deepening all the time, without apparent purpose or value but requiring more and more manic levels of activity from everyone trapped inside their job.

This suggests that capital, in the advanced, deindustrialised, economies, is experiencing a problem in reproducing the wage labour relationship on which it depends. There is nothing new of course in capitalism failing to provide full employment and relying on a reserve army of the unemployed to reduce wage pressure. What does look new is a certain difficulty they may be experiencing in persuading people that work, on all available terms and conditions, is actually the unqualified good it is supposed to be. In this difficulty capital is experiencing, once again but in a new form, the unforeseen consequences of its own development. If wage labour becomes unsustainable without state support, and if means testing then removes most or all of the benefits of work, then what’s so great about a job? If the need of capital for a deskilled, routinised labour denudes work, traditionally a source of pride and self respect, of all meaning then why should anyone value it?

There is a purpose to the growing bureaucratisation of capitalist employment, the bullshit jobs, other than simply disciplining us all into mindlessness. The endless unread records, the risk assessments, the bills and invoices, the charges, the quality standards, the supervision records, the never-consulted policy documents are there to allocate and protect income streams and support the claims of individual capitals within the overall system. ( And if there are no privatised income streams in a given system as yet, then the procedures are in place to allow them later). The function of most human labour for capital is, increasingly if not yet completely, to generate the records and claims, to police the procedures and processes, to manage and manipulate the human raw material

which are the origin of of the employing capital’s return, rather than to produce use values. All with a compulsory smiling face.

Employment is not coming to an end anytime soon. And it is emphatically not the case that there is no useful role for human labour and creativity; indeed global warming is a collective crisis that will need the full commitment of billions to negotiate.But it is possible now to suggest that capitalism itself has exhausted the potential of the wage labour relationship and is pointing towards a destination beyond - even while capitalism’s rulers and ideologues dictate an ever more frenetic commitment to the virtues of work in the abstract.

5. They are not, exactly, aiming to abolish the welfare state…

British capitalism has done well out of the welfare state. It kept the social peace after the war and was largely paid for by the working class who used it through National Insurance contributions and consumption taxes. Its expansion, which really began in the 1980’s, has opened up new possibilities. In work benefits have funded the expansion of low paid and part time employment. Housing Benefit - about a quarter of all working age benefit expenditure - has been turned into a hidden subsidy underlying the huge expansion of the private rented sector and its new class of rentier capitalists. A new, multi billion pound, industry has developed on the back of government contracts for welfare provision. And all the while the growth of indirect taxation, like VAT, has universalised the cost, spreading it right across the population.

People on benefits pay tax, quite a lot of it. The contrary impression is created by a discourse on taxation that is as as skewed and misinformed as that on benefits. Income tax, the only tax the government, and other spokespeople for ‘taxpayers’ like to mention, makes up only around 25% of all tax income. The true position is that around half of all tax receipts are accounted for by indirect, consumption, taxes and duties. These taxes are regressive; the lower your income the higher the proportion that goes on indirect taxation - because poor people necessarily spend all their income on immediate, taxable items while the rich can invest and save. Because of the combined effects of taxation and benefits the scale of the net transfers of income towards the poorest people is much smaller than is supposed or apparent. Work by Simon Duffy of the Centre for Welfare Reform has established that, as of 2009, people whose income fell in the lowest 10% of the population received a total transfer (roughly: benefits less tax paid) amounting to just £1,500 a year. The same people used much less than average of the services (education, NHS etc) provided by taxation so that, after allocating this cost saving, their net use of the welfare state in all its forms was negative. The maximum tax actually paid, by contrast, by the 10% on the highest incomes, net of benefits and services received, was about 27% - a remarkably good deal for the rich, given that these figures do not even touch on inequalities of property and wealth

They are not going simply to abolish something so useful for them. They are going to reconstruct it to meet capital’s needs. British capital, increasingly unable to find profitable openings in the production of commodities or the supply of services, needs access to all the revenues of the state, needs to have every transaction opened to it. Old style privatisations, where whole corporations were transferred from public to private sector, turned out to be not enough (capitalists still had to produce something in return for their new preserves). Better to tap straight into government income streams and auction off the rights of access. The Roman Empire had a crude form of the same idea with its tax farming. Absolutism introduced the sale of state offices. Under the modern version each and every state function can be let out to the highest bidder, avoiding any formal transfer of sovereignty or responsibility while allowing private capital a cut in every transaction, everywhere. That overall costs are inflated wildly in this process is of concern only if one believes that government is concerned with efficiency and economy: they are not; they are concerned with profits. The resulting extra expense after all is met by taxes and the deficiencies in service are of concern only to those who use them, not to our rulers.

Hence the reduction of the NHS to a brand, hollowed out and depleted, but not formally abolished. Hence the, still far from complete, spread of private contractors in welfare. Hence the entry of private finance into social housing and the resulting rent inflation. A welfare state of sorts will still exist in the future of capitalism but it will not be one socialists should lay claim to.

6. … not least because the present welfare state is their own, neoliberal, creation

The UK welfare system, as we now have it, is very largely a creation of the 1980’s and Thatcherism. Thatcher it was who began slicing away most of the 1948 vintage contributory system, and replacing it with means testing. Thatcher began the process of tightening discipline for unemployed claimants. Thatcher introduced new ‘in-work’ benefits (Housing Benefit from 1981) and expanded old ones - Family Income Supplement, introduced by the Heath government in 1970, but expanded massively under Thatcher and renamed Family Credit in 1986. She massively extended, instead of reducing , the scope of capitalist welfare. Council house sales were funded, for a time, directly by welfare payments while the parallel growth of private renting was, and is, underwritten by Housing Benefit. Thatcher again, or Major after her, closed all the old, lingering, Poor Law institutions. Those gigantic, Largactil sodden Gormenghasts, the mental hospitals that ringed London and other cities were replaced by community care while the land was sold off cheap. Council old peoples homes were forced to close while private nursing homes mushroomed everywhere - and this new financial architecture for care was funded almost entirely from the ever expanding welfare budget.

Above all Thatcher created mass unemployment which changed fundamentally the meaning of welfare. A contributory, insurance based system cannot survive when it becomes a long term means of support for millions. And Thatcher deliberately ensured that was the fate of the generations cast off by her de-industrialisation - miners, factory workers, dockers and all their dependants - they were all carefully allowed welfare to fall back on. In fact, notoriously, they were systematically encouraged, throughout the eighties, to claim the more generous sickness and incapacity benefits in order to reduce unemployment figures. And so welfare became a badge of defeat and despair, associated only with wrecked communities carved open by heroin addiction, offering not security but degradation. Its subsequent fall in popular esteem, through the nineties, should not have been a surprise.

All Thatcher’s policies were continued by her epigones. But now that - after the miners’ strike - the threat of organised class opposition had been largely seen off, the need for a comfortable welfare cushion had passed. Gradually, incrementally, and above all under the Blair government, the pressure on welfare recipients could be increased - for their own good naturally. Because worklessness was bad for you and only work was good for you. And there was enough truth in this for it to influence people, provided only that you forgot who had created mass welfare, and in whose interests. And since the left believed - still believes today in large part - that they were duty bound to defend the system created by Beveridge and Bevan, never noticing that its meaning and social content had been transformed by Thatcher, we had no effective answer.

7. They are converting the DWP into a punitive arm of the state

‘Services for poor people are poor services’ is a commonplace of social studies and has been true enough since the inception of the welfare state. What is happening under the Coalition’s reforms however goes above and beyond anything that went before.

Bureaucratic indifference was the characteristic emotional mode of the post 1945 welfare state, alternating with conservative moralising especially for single women with children. Benefit provision and personal social services were closely integrated under the original National Assistance scheme of 1948 so that claiming state support meant agreeing to moral supervision by the state. Children were still being transported to Canada and Australia by the British welfare state up to 1970. Mother and Baby Homes were widely used and children who escaped forced emigration faced equally forced adoption by middle class families, a process which reached a peak of 16,164 adoption orders made in 1968. Meanwhile hundreds of thousands of disabled people were incarcerated in asylums, long stay hospitals and homes run by Leonard Cheshire and similar charities - all lingering memories of the workhouses of the 19th century.

The Thatcherite welfare system that emerged from the 1980’s dispensed with most of these encumbrances, in favour of purely cash transactions. Hospitals, asylums, old peoples’ homes, were closed down and replaced with private sector residential provision, funded through Income Support (introduced 1988) and Housing Benefit. The Children Act (1990) and the Disability Discrimination Act (1995) represented major, genuinely liberalising, reforms introduced by Tory governments of the time; but they were also strategic withdrawals by the state in favour of market provision and monetised transactions. The introduction of Disability Living Allowance (1992, bringing together the existing Attendance Allowance and Mobility Allowance, with some loosening of conditions) similarly represented both a popular reform, responding to the demands of the disabled peoples movement (and DLA remains a genuinely popular benefit, pending its abolition) and a precursor to the extensive privatisation of care services which were to be funded to a large extent through DLA and Income Support.

Most fundamentally, it was the Thatcher governments that did away with the paternalistic exercise of discretion, left over from Poor Law days, in favour of a comprehensive, legalistic, code of entitlements - a change accomplished by the abolition of supplementary benefit in 1988 and its replacement by Income Support. This shift wrong footed most oppositional welfare rights organisations, formed in imitation of the much larger US movement for whom the establishment of legal rights and the enforcement of due process were central and continually contested objectives. But in a UK context the formalisation of welfare arrangements had multiple advantages for an emerging neoliberal state: it removed any scope for discretion by individual benefit officers, which might be influenced in its exercise by local political campaigns; it began the process of training claimants in the requirements of a neoliberal bureaucracy; and it enabled, in due course, the increasing automation and depersonalisation of welfare administration.

Blair and Brown left this modernised welfare largely untouched, with the addition of Tax Credits and Pension Credit. Their major contribution was to use what ideological credibility they had, as supposed heirs to and guardians of the post war welfare settlement, to popularise a neoliberal account of welfare. They began the promotion of work - any work - as the solution to all ills - and they could do so without raising hollow laughter because they were not saddled with Thatcher’s legacy of having recreated mass unemployment. They identified benefit dependency as a central ‘problem’ - meaning an opportunity to make political gains from attacking the poor - Frank Field was bemoaning the existence of a dependent underclass as early as 1989. They introduced ATOS and the work capability assessment to restrict the scope of sickness benefits in 2008. At the same time they introduced local housing allowance to the private rented sector - a necessary move in the development of the bedroom tax. They pioneered the involvement of the private sector ‘welfare to work industry’ in disciplining unemployed people. And they ‘modernised’ the Department of Work and Pensions.

This meant cutting tens of thousands of jobs, introducing features like call centres and the closure of local benefit offices. By 2010 it was already the case that it was impossible to see a DWP employee in person about your benefit claim, all transactions being handled by phone or in writing. The Coalition introduced new perversions to this already depersonalised system. Labour still occasionally used the language of customer service and satisfaction; the Tories pioneered the new concept of deliberately appalling customer service on the grounds that the customers were all worthless (the flip side of all those advertisements which urge a luxury service on you “because you’re worth it” - to which the only appropriate response is “how do you know?”).

Postal communication with the DWP is now a lottery which routinely takes weeks - all post being handled, or lost, by the giant West Midlands Mail Centre (1, Sun Street, Wolverhampton, is its rather extraordinary geographical address) and arriving at its destination, a Benefits Delivery Centre by unknown means. Since mail is never logged until is is acted upon any query you make about a claim, a letter, a sick note is invariably answered by the bland statement that the communication has not been received which is usually untrue but might just be the case so you have to send another … Naturally the DWP is promoting electronic communication - with the exception of e-mail. There are no e-mail facilities at all open to claimants to make enquiries about their claims. You can of course phone, if you can wait 20-30 minutes, when your call can be routed to a call centre anywhere in the country - and you have to pay for the call, only the initial claim being on a freephone number (which isn’t free on many mobiles). However the facility which formerly existed in Jobcentres to phone a benefit office was withdrawn from every Job Centre in the land in February 2014 for no reason at all except that it was a nasty thing to do. (Jobcentres are moving to an assisted service model and providing digital access to job search and benefit applications. As a consequence, we are removing warm phones from local jobcentres. Claimants who are vulnerable or unable to access our services in other ways will be assisted at their local office to resolve any queries that they have.' Esther Mcvey, Hansard, 10.2.14.)

And it goes on. Mandatory reconsideration, a procedure designed to prevent people appealing was going to take 2-4 weeks. It takes double or more and it is succeeding in its aim - appeal numbers have been cut drastically with the result thatthere is now no effective check on DWP decision making and maladministration. DLA claims were processed in 2-4 months - PIP claims take twice that or longer, as a side effect of the chaos surrounding ATOS. Short term benefit advances (STBA’s) proposed as the solution to delays, are next to impossible to obtain (just £3.3 million paid out in six months) with claimants being referred to non-existent local authority services or food banks to sort out DWP delays. This is administration as an open expression of class contempt.

If payment is so wayward as to be almost a punishment what of provisions that are actually intended to be punitive? The effects of almost a million sanctions a year are fairly well known. Less noted are a series of lesser punitive measures:

- penalties. If you are paid too much benefit for almost any reason, you do not merely have to repay the overpayment you receive a £50 spot fine as well. So you get a job, and not wanting to take an hour or more off work, you don’t phone the DWP until a few days later. You’re quite happy to pay back any overpayment - but you’re fined as well - in effect fined for finding work.

- overpayments - at present you only have to repay overpaid benefit if, loosely, you are responsible for the overpayment occurring. If it’s an official error you don’t have to repay it. When Tax Credits were introduced, with overpayments guaranteed however scrupulous you were about notifying them, the Brown government decreed that all overpayments would be recovered, subject only to an official mercy provision. Universal Credit adopts the Tax Credit rule

- benefit fraud can now be punished not only by a criminal sentence (now with extended sentences) and not only by having to repay any overpaid benefit (both of which have always happened) but also by a three year ban on claiming any other benefits and total recovery of any assets (house, car) under the Proceedings of Crime Act (POCA).

The neo-liberal welfare state, then, sees punishment as a central purpose, not as an adjunct to good administration or an incentive to good behaviour. The boundaries of punitive welfare furthermore extend well beyond the DWP. Local authority Social Services Departments are increasingly called upon to exercise punitive measures from repatriation to the removal of children. Both the Tories and Labour have plans to extend this role and deepen local authority involvement in the discipline of ‘feckless’ or ‘troubled’ families.

This poses a problem for socialists and trade unionists working within the welfare system. There comes a point when the ability to moderate the system from inside no longer seems adequate compensation for the cruelties that you are required to participate in. This is not an easy judgment to make. There has always been a tendency within state bureaucracies, and many other institutions to develop a contemptuous attitude to the punters, tempered perhaps by a recognition of their necessity. And of course there is no shortage of annoying and obnoxious claimants. However the sharper grows the contradiction between, say, the PCS’s official, very civilised, stance against welfare reform and the behaviour required of its members, and the longer unions put off any effective opposition to the transformation of the social content of their members’ work, on the spurious grounds they they are concerned only with the terms and conditions of that work, the more difficult it becomes to justify continued participation in a state campaign of enforced hunger and petty tyranny. Effective sabotage then becomes the minimum requirement of an active conscience and obstruction of the system a central campaigning objective for socialists both inside and outside the neoliberal welfare system.

8. They are looking to create a low waged, unskilled, precarious workforce

That’s forever incidentally, if they get their way, and not just for young people. And it’s for nearly everyone - middle class professionals and the skilled working class not excluded. This is only in small part a result of globalisation; in greater part it is about automation reducing the need for human labour, skilled labour especially, everywhere in the world (so it isn’t a trend that can be reversed by ‘reshoring’ as the Greens like to imagine). The drive to automation, and simple, tightly specified, repetitive procedures in those areas that cannot be automated, is relentless. From teachers and university lecturers facing replacement with unskilled assistants simply following prescribed textbooks, to train drivers and signallers displaced by automatic train operation, to law firms applying mass production techniques to litigation, capitalism no longer requires our skills and creativity; just that we follow procedures. Even in areas generally assumed to be the preserve of human labour - like the provision of care to other humans - automation strides on in the form of assistive technology. Not the least significant reason for the rise of ATOS was their use of computer based systems to bypass the role of expensive doctors in medical assessments.

They have made substantial progress. As David Renton almost pointed out it seems likely (official statistics are inadequate to capture this) that something under half of the total population of working age is now in full time, secure, employment: the rest, the majority, being unemployed or otherwise inactive, self employed, in part time work, or in variously casualised forms of full time employment. And the sustained fall in real earnings since 2010 is now underwritten by the guarantee of a workforce of millions forced into accepting any work available by Jobcentre sanctions.

At the same time they are enmeshing the wages system at every level with state provision and taxation. Fifty years ago the primary, often the only source of income for working class families was the wage packet or salary. They generally didn't pay much, if any, income tax out of this, just national insurance. Today for anyone on or below average wages, for anyone in rented accommodation, for anyone with children or a disability, their financial relationship with the state is likely to be as important - as determinative for their standard of living - as their wage - which is itself set by the state for anyone on or near minimum wage. Income Tax and NICs, Child Benefit, Tax Credits, Housing Benefit, council tax reductions, DLA, free nursery places, prescription charges, TV licences, free school meals, student loan repayments, care charges if a family member is disabled - and so on, and so on. All of which has to be claimed, every detail verified, every change reported.

A central aim of welfare reform is to is to enforce this new White Collar Taylorism. Jobcentres are the Board Schools of the day training people of all ages to submit to meaningless bureaucratic procedures, teaching by rote the infinite virtues of work, and handing out lessons in hunger and penury to any who will not submit. And Universal Credit will seal off all the exits.

9. They are enforcing a patriarchal discipline on women and families by means testing

Separate income tax assessments for couples were introduced in 1990, abandoning any assumption about family composition and income structure and ending any interference by the state in the private lives of people paying income tax. Ironically this interference had to be partially re-introduced when the Coalition tried to introduce taxation of Child Benefit for higher band income taxpayers in January 2013. They then realised they had no means of knowing when taxpayers were members of a couple, information they needed to apply the new rule. But for benefit and Tax Credit claimants the requirement to inform the state when you began to live with anyone never went away and has always been rigorously enforced (as the Child Benefit rule won’t be).

If you start to live with anybody “as man and wife”, or “as civil partners” for same sex couples, and you claim means tested benefits or Tax Credits, you must inform the DWP or the Revenue immediately or risk benefit fraud sanctions and prosecution. (Anyone who falls foul of the new Child Benefit rules by contrast is penalised, if at all, under the much gentler income tax rules - they may have to pay something back but there is zero chance of prosecution). And they decide when you are living with someone, not you, under very opaque guidelines.

The result is that poorer women, in particular, live with the permanent threat of state scrutiny of their personal and sexual behaviour:

- your son storms out after a row. You don't know if or when he's going to move back in but he keeps coming back for a sub. So you keep claiming for him.

- or your kids are taken into care. You want them back but you've got a dodgy boyfriend so the social workers will only let you have daytime contacts - no overnights. You've still got the expenses so you still claim for them.

- or your boyfriend sort of comes and goes. Good fun when he's around, brings drugs for you and presents for the kids. But you've got two kids and you can't rely on him so you claim as a single parent. BIG overpayment because he used your address to apply for a credit card and you can't prove he wasn't there most of the time.

- or you get divorced but you can't get rid of your ex. He keeps coming round because he can't find anywhere half decent to live so you drift into letting him sleep on the sofa. That neighbour you quarreled with phones the fraud hotline and you're in Court for cohabitation.

The mistake people make is to assume that the complicated messes they make of their lives are their problem and their business. WRONG. If you're poor and claiming benefit, and especially if you're a woman with children, it's the state's business and you account for it in Court. This is happening every day - Styal prison is half full of women caught for ‘cohabitation’. Because it only happens to poor people, and mainly to poor women, it is considered acceptable. It is a direct consequence of a means tested benefit system, and is high on the list of reasons for abolishing any such system.

10. They are winning ...

We all knew bad things were approaching after the 2010 election, that Austerity was coming. Others have written about the false choices being posed by all the parties then and about the gradual rise to dominance, the dominance of commonsense, of a set of neoliberal ideas over the preceding decades. But the particular form austerity took was not preordained. That welfare reform took centre stage from the beginning, from the first wave of welfare cuts announced in the June 2010 emergency budget, was a deliberate political choice by the Tories. They knew where they would be strongest, they knew that cuts to welfare would receive no effective opposition. And they were right. They were able to tap into deep reserves of resentment, confusion and deliberately created ignorance and shift, massively, the terms of public debate and perception. Let no-one, inhabiting an oppositional environment, doubt how much ideological damage has been done. They have been able to make cuts in provision previously thought impossible. Most of the cuts were announced in 2010 and although their consequences, as they came into effect, were both predictable and predicted, a stunned silence was the response where opposition might have been expected.

An inadequate way of understanding the ideological distinctions now being drawn by neo-liberalism is to refer back to the age old distinction between deserving and undeserving poor. This is not the current proposition. While the theoretical possibility of deserving poverty is still allowed for, the notion of a deserving benefit claimant is not. Only pensioners are exempt from this rule, for now. Again and again, in the poverty porn shows, in newspaper exposes, it is the fact of claiming benefit that is damning, even, in fact characteristically, for people who are in work. This is not a mistake or misunderstanding. The point is to demean and stigmatise receipt of welfare, whatever the reason for it, and thereby to create a new pauperism, not so much for its own sake, but as at once a standing threat, and a despised and feared minority for everyone else

The left, including the revolutionary left, has paid little or no attention to the emerging new role for welfare outlined here. No-one theorised the significance of the in work benefits introduced under Thatcher in dampening down traditional forms of class struggle, other than routinely to deprecate them as a subsidy for low paying businesses. We deplored the piecemeal destruction of social security and its replacement by means testing but offered no analysis of the reasons for, or consequences of, this consistent shift towards greater state control of claimant’s lives. We have been content very largely to rely on a modestly critical account of the achievements of 1948, at most trying to extend or liberalise that settlement - not least perhaps because much of the left has made its home in the welfare institutions that have grown up since 1948. And when opposition has been expressed it has usually been in terms of ‘unfairness’, of attacks on the ‘vulnerable’ and ‘needy’; terms which the Tories were equally happy to use (and reverse the meaning of by inserting ‘genuinely’ or ‘the most’ in front of them). We should ask ourselves before using such words whether we would be happy to apply them to ourselves - as distinct from frank and respectable words like ‘poor’ and ‘claimant’. The alternative language of asserted ‘rights’ and entitlements was better but won equally little purchase. We might have done better to take seriously the idea of benefit dependency as something to be resisted.

When resistance did emerge - first in the student riots of 2010, then in the campaigns against ATOS and the bedroom tax - it came about largely outside the existing structures of the Left (there were no Trudges Against ATOS from Hyde Park to Trafalgar Square). The small victories that resulted give us some space not just to work out how to resist further cuts to welfare, which will come whichever party of capital is in power, but also to ask, not so much how to win the war on welfare, rather what a victory for our side would even look like.

11. ...and Universal Credit will seal their victory for a generation

Complexity in a welfare scheme is generally seen as an unavoidable cost of fairness. Outcomes must reflect either people’s needs, in a means tested scheme, or their contributions in a contributory or an insurance based scheme; and these factors are infinitely variable. But complexity has other implications. It deprives people of control of their own income and vests that control in a separate, expert, caste. It makes people’s income a mystery and therefore allows myth, disinformation and resentment to grow unchecked. It disempowers and infantilises.

No surprise then that the Coalition government’s long term fix for welfare - Universal Credit - uniting as it does most DWP benefits with housing benefit and tax credits, sets a new high water mark for the floods of complexity. The fact that the government computer systems aren’t up to the job is entirely welcome but given cross party support for the principles of Universal Credit, not perhaps for long. They will introduce it anyway - are introducing it slowly - and provided the effects of all the inevitable chaos of errors and missing payments is felt only by the poor, will congratulate themselves on a job well done.

Universal Credit is intended to replace entirely most existing benefits - Income Support, Housing Benefit, ESA, JSA, Income Support - and all Tax Credits. A single, common, means test will apply to all claimants and a common range of ‘conditionalities’ - from the full work seeking requirement applied to unemployed claimants to no requirements for a few of the most severely impaired disabled people. A common, online or telephone, administration and claims system will be introduced. All payments will be monthly in arrears (causing long delays at the start of a claim) and adjusted in line with the previous months earnings through a realtime link to the PAYE tax system (or by monthly declarations of income for self employed people). All overpayments, however caused, will be recoverable. Immediate penalties will be in place for any claimant errors. All payments of UC, whether for housing costs, children or adults will be subject to sanctions for breaches of conditionality.

The claimed advantages of this totalitarian system of control are that it will “improve work incentives”. This claim is still repeated by a lot of organisations in the welfare sector who should know better. True there is a more generous ‘disregard’ - the amount of income that can be earned before UC payments are affected - for some people. But the rate at which UC will be withdrawn once it starts to be reduced for earnings - 65%, or about 85% for householders liable for council tax - is no better, or worse, than under present systems; self employed people will, after 12 months, be assumed to be earning at least minimum wage, whatever their actual takings; and there is nothing like the delay effect in Tax Credits where additional earnings did not take affect until the next tax year, which often worked to claimants’ advantage.

Similarly claims that people will be better off under UC are almost entirely illusory, with losses more than balancing gains. Extra expenditure under UC is caused entirely by ‘transitional protection’ - maintaining existing claimants on their current benefit rates, but frozen, where they would otherwise lose out. And Mr Duncan Smith’s repeated claims that take up rates will improve under UC are pure fantasy. Most people, I predict. will undergo a great deal of deprivation rather than claim this nightmare benefit. But we will never properly know this because the government, quite uncoincidentally, are going to stop collecting data on the take up of means tested benefits.

Then, even in cases where there is a slight gain, who will actually receive it? Families claiming benefit or tax credits under present arrangements will generally have several income streams - tax credits, child benefit, DWP benefits, earnings - which will usually be divided among both members of a couple. But for UC only one person can claim (although both members of a couple are liable to sanctions). The entire income of a family (apart from Child Benefits and earnings) will be dependent on the UC claim, deepening the financial dependence of women (mostly) in couples and making all low income families just one official error away from penury. Direct payment of the rent element in UC which replaces Housing Benefit (direct to the claimant that is, rather than the landlord) could ameliorate this slightly but the DWP are back-pedalling fast on this in the face of protests from social landlords.

Finally, in so far as anyone is notionally better off under UC, how is this funded? The bulk of the cuts fall on the most severely impaired disabled people. The ‘severe disability premium’ a £61 a week addition to most low income benefits for people with the most severe impairments, and a keystone in the financial architecture of most supported housing schemes, is abolished under Universal Credit (although existing claimants will have their current payments frozen at present levels under transitional protection).

Universal Credit, in fact, is the realisation of a long held neoliberal dream. In 1962 Milton Friedman advocated a scheme for a negative income tax for the USA. This was to replace the entire US welfare and social security system with a common, universal, means tested benefit integrated with the income tax system with the aim of ‘making work pay’ and applying common conditionalities. In fact the closest approach to implementation of such a system in the USA was Nixon’s proposal for a Family Assistance Programme which covered families with children only and did not make it through Congress (so that, uniquely among developed capitalist countries, the USA has never had a comprehensive minimum income guarantee scheme).

Friedman’s disciples in the UK however have now seized their chance with Universal Credit. The only aspect of Friedman’s scheme on which it falls short is integration with income tax; in all other respects UC is the perfect neoliberal benefit. Automating administration reduces costs. Universal, graded, conditionality with sanctions and penalties, disciplines the entire underclass of their fantasies. The live feed of earnings information from PAYE ensures a seamless join with even the most casualised forms of work. The system is, by design, ideally suited to zero-hours contracts, precarious jobs and total casualisation. Millions of people in permanent, automated dependency are set to make Friedman’s fantasies real.

12. They have a problem with pensioners, which they have yet to sort out

Thus far the Coalition have avoided tackling the problem of pensions, a growing and unwanted expense for capital. They have excluded most pensioner benefits from the war on welfare, in the hope of gaining a short term electoral advantage. They have allowed the benefit for the poorest pensioners - Pension Credit - to be eroded in value but protected the universal State Retirement Pension. But this still leaves them with a growing pensioner population and a growing cost to which Cameron has committed the Tories at least, indefinitely. The calculation has been that the electoral return on this cost (that is the degree of consent to neoliberal, austerity policies) has been sufficient to justify the expense - but the calculus here can shift.

One effect of all this is that the one date which is imprinted in the psyche of most poor people from their late 50’s on is their qualifying age for state pension credit (QUASPC - yes it’s an acronym). This is actually female retirement age but also the qualifying age for pension credit for men and for mixed-age couples; it is going up continuously until 2021 by which time it will be 66 for both sexes; until then it changes month by month. This date acts like a promise of deliverance and plenty when you’re struggling along on on JSA or ESA. Your money will often more than double overnight on that frabjous day. Problems like the bedroom tax and abolition of council tax benefit will simply evaporate. You escape the benefit cap and get guaranteed annual upratings. You can no longer be vilified in the press and on TV; you have suddenly become a meritorious citizen with richly deserved entitlements, not a scrounging lowlife. You have moved into a different realm and have your bus pass as proof of citizenship there.

Pensioners in fact are being recreated as a separate, loyalist, enclave within the neoliberal state, whose political effectiveness was apparent in Indyref - around 70% of Scottish pensioners voted ‘No’. This is a development not confined to the UK - social security and Medicaid, the principle elderly benefits in the USA, were exempt from most of the Reagan and Clinton welfare cuts - and relatively recent - the more generous treatment of the elderly poor in the UK dates only from the 1990’s.

Within that enclave things look different. Income inequalities within the pensioner population are real enough but lower than in the rest of the population and are, for now, decreasing. Welfare cuts do affect some pensioners but not very visibly. Pensioner poverty is at lower rates than poverty elsewhere and mitigated by the continuation of the full range

of free services - prescriptions, bus travel, TV licences etc. Pensioners, at the most basic level, do not tend to use food banks.

The problem for the ruling class is that this relative generosity is unsustainable. They have the sketch of an outline for a solution. They will abolish the efficient, low cost, SERPS and replace it with a flat rate pension, leaving the field open to the private pensions industry to sell its high cost, massively corrupted wares as a supplement. Then they are considering privatising the administration of State Pension to create yet another cash flow infusion for needy contractors. They will raise state pension age - to 66 for both sexes from 2021 - and keep raising it. They will squeeze the life out of public sector pension schemes, purloining the assets wherever they can. They will ration, cut back, automate and inflate the charges for, both social and NHS care. They will try to incite generational resentment. But still approaching 60% of the welfare budget is directed at pensioners and they need more ways of getting at this income stream.

They are divided about what further moves to make. The Tories have committed themselves to maintaining present provision for another electoral term in a straightforward calculation of the political benefits. Labour politicians are practically wetting themselves in their eagerness to present their alternative, their hands spearing the air like a coven of Hermione Grangers - ‘Please sir, we know the answer’ - as they audition for the government role.

13. Labour are as deeply committed to these aims as the Tories

The opening words of the National Assistance Act 1948 were an unusually forthright statement of intent: “The existing poor law shall cease to have effect”. In many ways this was a high point, in the UK, for the long wave of working class resistance which shaped the first three quarters of the twentieth century. It was a real, not a symbolic victory: there were no more workhouses, there was no household means test. A centuries old nightmare was lifted. This was actually a cross-party achievement. The Tory R A Butler spoke powerfully, if pompously, in favour of ‘social certainty’, a phrase he preferred to ‘social security’. The Liberal Beveridge made most of the proposals, which were significantly watered down by the Attlee government (benefit rates for instance were set at a level - and have remained there - 30% below Beveridge’s recommendations). But it remained the core element, the collectively remembered centre, of Labourism the ideology and to a lesser extent of the Labour Party.

But Labour are a party committed to governing under capitalism, meaning that they must always, ultimately, be alert first to the needs of capital. Labour could not have instituted the system of neo-liberal austerity in as sweeping or decisive a way as did the Coalition in 2010, which is why they were destined to lose that election - and when the electorate showed signs of confusion about the historic necessity of austerity our ruling class had Gus Macdonald in place to finesse the right outcome.

Yet if Labour could not have initiated austerity, they are now well placed to continue it after 2015, on-message, online and eager to prove just how tough they can be. They have made precisely two commitments in advance - to abolish the bedroom tax (in fiscal terms a minor element in the Coalition’s assault significant mainly as a step towards equalising rent and other conditions between social and private housing provision and the eventual subsumption of the former under the latter; a process which can be advanced by other means) and to replace the Work Programme with a scheme to provide 25 hours a week at minimum wage for long term unemployed people (with ample supervisory contract opportunities for the welfare to work industry).

Of the remaining Coalition welfare cuts, £23 billion a year of them, Labour are committed to restoring none at all. Their recent commitment to review the work capability assessment is almost perfectly free of content since it says nothing about altering the detailed conditions of that assessment. Of the central coalition strategy - to extend the reach of welfare further into the underemployed and casualised working class, and to deepen means testing and conditionality through Universal Credit - Labour have uttered no criticism. (They have criticised the implementation of Universal Credit but not its aims; they have made occasional noises about the growth of in-work benefits but no systematic critique). In this they are following well established tradition. Welfare policy since 1948 has been a matter of bipartisan agreement most of the time, rhetorical flourishes aside.

The one theme Labour have consistently if quietly drawn out is the continuing existence of the universal pensioner benefits - free bus passes, TV licences, prescriptions and ultimately State Retirement Pension itself. These they plan to means test, using fake leftist arguments - why should we be subsidising wealthy pensioners when everyone else in suffering? - where necessary. That is the significance of Labour’s most pointed policy difference with the Tories about post 2015 welfare - Labour’s version of the overall welfare expenditure cap will include the State Pension; the Tory’s version will not. It will be Labour’s role, should they win in 2015, to finish off the final surviving, non-means-tested, pensioner, elements of a once universal welfare state - and they will use the authority and memory of 1948 to perform this task for capital.

14. Why it’s Welfare, not Social Security

Social Security was the name given in the 1940’s, in the UK and in the USA, to a certain pattern of welfare provision. Men (women were an afterthought assumed to be dependent on their males and provided for mainly as widows) paying in to a state run insurance scheme could receive relatively generous, non means tested, benefits in the event of unemployment or incapacity, and on retirement. Even on its introduction in the UK, in 1948, it soon became clear that Social Security could not and did not provide for a wide range of people and the role of the means tested National Assistance scheme, originally intended as as a residual safety net, was more substantial than expected. Post war demographic trends - increasing numbers of single parents, increasing lifespan especially for disabled people - then increased the role of what, in 1966, became Supplementary Benefit.

Nonetheless Social Security survived intact for the first thirty years after 1948 because unemployment was, for most of this period, a forgotten problem in the post war boom. Only in the 1970’s did the strains start to show and only in the 1980’s did the Thatcher government draw appropriate conclusions. Margaret Thatcher did not embark upon the sort of all out assault on ‘welfare’ that her successors are engaged in. Indeed her government were happy to oversee the massive expansion of welfare as a safety valve after they had deliberately recreated mass unemployment. Instead they did two things - they systematically chipped away at Social Security, time limiting Unemployment Benefit for instance and restricting the State Earnings Related Pension Scheme (SERPS), while expanding means tested welfare in the form of Housing Benefit, Family Income Supplement (the precursor of Tax Credits) and Income Support. The last rites for Social Security are now being gabbled through at indecent speed by the Coalition with the time limiting of contributory ESA, from April 2012, and the forthcoming abolition of SERPS.

The replacement of social security by welfare (which to anticipate objections is neither an American word nor a neologism - if you really don’t like ‘welfare’ though I won’t quarrel if you just call it ‘benefits’) has been an accomplished fact these thirty years. Recent Labour Party gestures - one proposal is for a slightly enhanced rate of contributory JSA for those with five years or more of NI contributions - are an attempt to create a nostalgic backlash pitting the respectable working class of Frank Field’s fantasies against the welfare horrors. (“Is that all?” is the invariable cry of someone pitched from secure work onto the dole when they learn what they will get). It will fail because there is no real nostalgia for social security which was at best a grudging, convoluted, bureaucratic and sexist scheme, funded by a regressive tax (National Insurance), which locked in existing patterns of inequality and couldn’t cope at all with international labour mobility. We waste our time by mourning it. Instead we need to rethink the whole history and experience of the English Poor Laws, past and present, and come up with something better.

15. Why it’s back to 1601 not 1834

Early modern welfare began in 1601 when the nascent English capitalist state introduced the first Poor Law and began the process of replacing private and Church provision with the ministrations of a secular state machine - a machine which created itself, at a local level in England, largely for and through this purpose. This settlement for the rural poor became firmly established, with remarkably little opposition, after the English Revolution. It became an essential element in dampening down what would otherwise have been the turbulent process of dispossession of the surviving peasantry and the establishment of a still largely rural working class disciplined to the wages system. It was able to root itself firmly in the new society, despite regular objections and disputes, because its costs - the poor rates - were administered in and through sections of the local ruling class who were able to establish certain perquisites and advantages for themselves in terms of subsidised labour and rents. And, incidentally, it warded off the intermittent famines still endemic in the rest of Western Europe.

By the early 19th century, developments within British capitalism, mandated a new approach. The centre of capitalist development had moved to the cities and factories and it was now the urban working class that required discipline while rural Poor Law provision had become a drag on development. Step forward Edwin Chadwick, Bentham’s creature, to introduce the new, workhouse based, ideologically sound, drastically cut down Poor Law of 1834. Most of the ideology turned out to be fantasy and Chadwick himself was removed when inmates at the Andover workhouse, operating under his precepts, were found to be eating the rotting animal bones they were given to crush, but the New Poor Law survived riots and armed risings to enforce the mass transfer of rural labour to the new industrial cities and to terrorise generations to come.

There is a natural tendency therefore to see the Coalition’s premeditated war on welfare, launched in 2010 as the successor to, and through the prism of, Chadwick’s reforms 180 years earlier. And there is reason to suppose that Mr Duncan Smith, a vain man, is fully aware of the parallel and eager for a Chadwickian place in history. Nonetheless the outcome of the current war on welfare will be something much closer in spirit to the 18th century poor law, an extensive system accommodating ruling class needs at every level, than the minimal, workhouse based, 19th century version. We are not, in any literal sense, going back to the workhouse (workhouses, apart from anything else, were expensive). The Victorian ruling class, especially its industrial fraction, benefited from the 1834 Poor Law because it removed any floor to working class living standards and therefore licenced intensified exploitation while at the same time supplying the necessary workforce by forcing agricultural workers off the land. However they did not profit directly from its operations on any scale and all support for people in work was, in principle if not quite in practice, abolished. The 21st century settlement by contrast prioritises capital’s involvement at every point in the system through subcontracting its operations. It provides an extensive system of subsidies to rents and wages. It disciplines claimants into complying with mindless bureaucratic processes, which mimic those of capitalist employment. It subjects every element of support to an intensely intrusive and oppressive means test. These features are not incidental, not mistakes or policy failures. Private provision at every level, subsidies for rents and salaries, intrusive means testing and bureaucratic discipline are the very core and purpose of 21st century welfare’s New Speenhamland System.

16. No-one asked for welfare